Search

Diamlorem tellus orci ullamcorper risus nesciunt netus.

113 Fulton Street, Suite 721 New York, NY 10010

Recent Posts

- Planning to manage your clients December 16, 2020

- Grow up your business successfully December 16, 2020

- Meet the gadget of the year December 16, 2020

- Make your successful business with App December 16, 2020

- How to grow up your business December 16, 2020

Categories

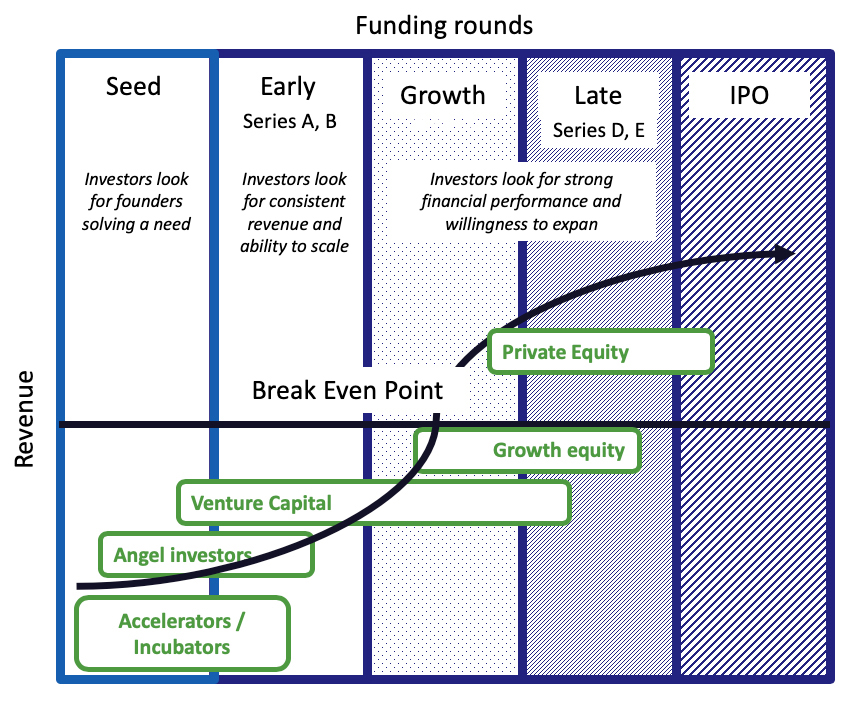

Equity Funding

Made Easy

- Pre-Seed Funding

- Seed Funding

- Early Series

- Growth Series

- Late Series

- Mezzanine Funding

Why Choose Us

3 Stages of Equity Funding Process.

Pre-Offering

(before approaching investors)

Offering

(liaising with investors)

Closing

(securing partnership with investors)

Step-By-Step Guide to Raise Equity Funding

Step 1 : Define funding strategy

Pre-offering

So, what deal are you looking for? What are you hoping to walk away with? What percentage of your business are you willing to part with in return for capital? Are you looking for mentorship or purely funds? The first step in the capital raise process is deciding exactly what success looks like for you.

If you have a clear plan in mind for the funds you want to secure, you’re more likely to secure investment, plus execution then becomes as easy as simply following your plan.

So, what deal are you looking for? What are you hoping to walk away with? What percentage of your business are you willing to part with in return for capital? Are you looking for mentorship or purely funds? The first step in the capital raise process is deciding exactly what success looks like for you.

If you have a clear plan in mind for the funds you want to secure, you’re more likely to secure investment, plus execution then becomes as easy as simply following your plan.

Step 2 : Prepare business detail

Your business cannot exist in your head when you present to investors. Now is the time (if you haven’t already) to research, document and project (accurately) your numbers (users/customers, revenue, expenditure etc).

Investors will want to know about the market potential, your business model, your marketing strategy, budgets and so much more. Make sure you have this information at your fingertips.

Make it easy on yourself. Download the capital raise checklist now.

Investors will want to know about the market potential, your business model, your marketing strategy, budgets and so much more. Make sure you have this information at your fingertips.

Make it easy on yourself. Download the capital raise checklist now.

Step 3 : Find investors

Do your research. What investors are active in your space? Scour your network of contacts for a connection that might be able to give you a warm introduction. Contact top-tier business schools to see whether they can point you in the right direction. Create a profile on AngelList and apply to MicroVentures. Believe it or not, finding investors is not the hardest part about securing funding. However, if you’re struggling, you might consider appointing a financial advisor.

Step 4 : Create Investors Pitch deck

You’re going to want to make investors an offer they can’t refuse, and that requires an immaculately prepared presentation. Of course, your most compelling business detail will feature here, but it’s also worth noting that Angel Investors love a story.

Pitch to your friends. Pitch to your colleagues. Pitch to friendly business contacts to get their views. Not only will the practice “make perfect” but it’ll also give you a chance to get other people’s insights and incorporate them as you see fit.

Pitch to your friends. Pitch to your colleagues. Pitch to friendly business contacts to get their views. Not only will the practice “make perfect” but it’ll also give you a chance to get other people’s insights and incorporate them as you see fit.

Step 5 : Organize meetings

Offering

The private equity capital raising process can be a numbers game in more ways than one. Make sure you schedule plenty of meetings to give yourself a good chance of landing at least one. This part of the capital raise process is often called the “presentation roadshow”. Remember, if you’re approaching venture capitalists, your business needs to be established in some way - a good story will only get you so far.

The private equity capital raising process can be a numbers game in more ways than one. Make sure you schedule plenty of meetings to give yourself a good chance of landing at least one. This part of the capital raise process is often called the “presentation roadshow”. Remember, if you’re approaching venture capitalists, your business needs to be established in some way - a good story will only get you so far.

Step 6 : Facilitate the due diligence process

The work isn’t done just because the pitch is over. Once you’ve wowed investors with your presentation, it’s time to follow through with some impressive evidence. Interested investors will want to do due diligence, so having everything already prepared for them in a virtual data room is a huge plus.

Step 7 : Create the Negotiate partnership agreement with Shareholders Agreement.

Closing

You’re so close now, you can almost smell the success. Remember, when drawing up the partnership agreement, it must work for you, your investor, and the overall business. Many startup owners don’t protect their own interests well enough. Plan for the long-term and use a good lawyer to ensure the detail is considered.

You’re so close now, you can almost smell the success. Remember, when drawing up the partnership agreement, it must work for you, your investor, and the overall business. Many startup owners don’t protect their own interests well enough. Plan for the long-term and use a good lawyer to ensure the detail is considered.

Step 8 : Sign and celebrate!

You’ve done it. Congratulations! Your patience and hard work have paid off - now you can put your plan into action and show the investor that your business is the success you know it can be.